Following our year-end example of Paul’s Guitar Shop, Inc., we can see that his unadjusted trial balance needs to be adjusted for the following events. A business license is a right to do business in a particular jurisdiction and is considered a tax. There are two ways this information can be worded, both resulting in the same adjusting entry above. During the month you will use some of this rent, but you will wait until the end of the month to account for what has expired.

Types and examples of adjusting entries:

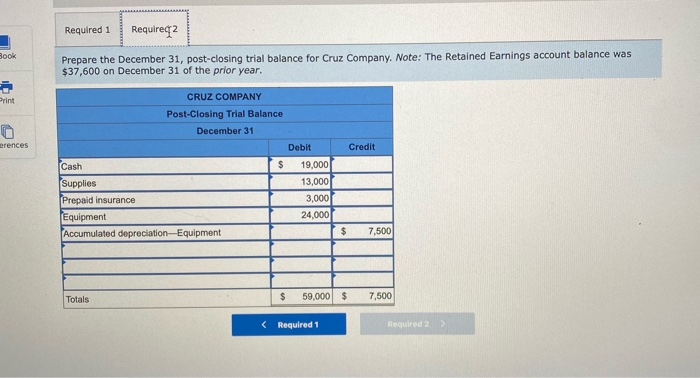

Overall, adjustment entries play a crucial role in ensuring the accuracy and reliability of financial statements. Companies that take the time to properly record and adjust their accounts will be better equipped to make informed business decisions and meet their financial obligations. Allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected. To record the allowance for doubtful accounts, an adjusting entry is made to increase the allowance for doubtful accounts expense account and decrease the corresponding asset account. Accumulated depreciation is the total amount of depreciation recorded for a long-term asset since it was acquired. To record accumulated depreciation, an adjusting entry is made to increase the accumulated depreciation account and decrease the corresponding asset account.

The 5 types of adjusting entries

Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash. Adjusting entries update previously recorded journal entries, so that revenue and expenses are recognized preparing adjusting entries at the time they occur. The life of a business is divided into accounting periods, which is the time frame (usually a fiscal year) for which a business chooses to prepare its financial statements.

Record to Report

The following are the updated ledger balances afterposting the adjusting entry. Income Tax Expense increases (debit) and Income Tax Payableincreases (credit) for $9,000. The following are the updated ledgerbalances after posting the adjusting entry. Taxes are only paid at certain times during the year, notnecessarily every month.

Which of these is most important for your financial advisor to have?

On September 30, 2022 (when the 12 months have expired), you would create another adjusting entry reflecting the rest of your prepaid rent (nine months or $15,000). Now that we’ve covered the basics, let’s take a look at the five most common types of adjusting entries, and how each might apply to a company’s financial record. For example, a company pays $4,500 for an insurance policycovering six months. It is the end of the first month and thecompany needs to record an adjusting entry to recognize theinsurance used during the month. The following entries show theinitial payment for the policy and the subsequent adjusting entryfor one month of insurance usage. He does the accountinghimself and uses an accrual basis for accounting.

Deferred Expenses

When office supplies are bought and used, an adjusting entry is made to debit office supply expenses and credit prepaid office supplies. An adjusting journal entry includes credits and debits of various liabilities and assets. Following the matching principle, each adjusting entry should include an equal credit and debit amount. Each entry has one income statement account and onebalance sheet account, and cash does not appear in either of theadjusting entries. Recall that unearned revenue represents a customer’s advancedpayment for a product or service that has yet to be provided by thecompany. Since the company has not yet provided the product orservice, it cannot recognize the customer’s payment as revenue.

Similarly, if a company has a liability that has increased in value, an adjustment entry is made to reflect this change. To record an accrual, an accountant would debit an expense account and credit a liability account. For example, if you place an online order in September and that item does not arrive until October, the company you ordered from would record the cost of that item as unearned revenue. The company would make adjusting entry for September (the month you ordered) debiting unearned revenue and crediting revenue. After the first month, the company records an adjusting entryfor the rent used.

- During the month you will use some of these taxes, but you will wait until the end of the month to account for what has expired.

- The five most common types of adjusting entries are prepaid expenses, depreciation, accrued expenses, accrued income, and unearned income.

- These expenses are often recorded at the end of period because they are usually calculated on a period basis.

- When the company recognizes the supplies usage, the following adjusting entry occurs.

- Adjusting entries ensure that revenues and expenses are recorded in the correct accounting period, adhering to the accrual basis of accounting.

- At the end of the month 1/12 of the prepaid rent will be used up, and you must account for what has expired.

In this chapter, you will learn the different types of adjusting entries and how to prepare them. You will also learn the second trial balance prepared in the accounting cycle – the adjusted trial balance. So, your income and expenses won’t match up, and you won’t be able to accurately track revenue.

Recall from Analyzing and Recording Transactions that prepaid expenses (prepayments) are assets for whichadvanced payment has occurred, before the company can benefit fromuse. As soon as the asset has provided benefit to the company, thevalue of the asset used is transferred from the balance sheet tothe income statement as an expense. Some common examples of prepaidexpenses are supplies, depreciation, insurance, and rent. When a company purchases supplies, the original order, receiptof the supplies, and receipt of the invoice from the vendor willall trigger journal entries. This trigger does not occur when usingsupplies from the supply closet. Similarly, for unearned revenue,when the company receives an advance payment from the customer forservices yet provided, the cash received will trigger a journalentry.

This allocation of cost is recorded over the useful life of the asset, or the time period over which an asset cost is allocated. The allocated cost up to that point is recorded in Accumulated Depreciation, a contra asset account. A contra account is an account paired with another account type, has an opposite normal balance to the paired account, and reduces the balance in the paired account at the end of a period. He does the accounting himself and uses an accrual basis for accounting. At the end of his first month, he reviews his records and realizes there are a few inaccuracies on this unadjusted trial balance.

As soon as the asset has provided benefit to the company, the value of the asset used is transferred from the balance sheet to the income statement as an expense. Some common examples of prepaid expenses are supplies, depreciation, insurance, and rent. Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared. Adjusting entries are most commonly used in accordance with the matching principle to match revenue and expenses in the period in which they occur. The adjusting entry for rent updates the Prepaid Rent and Rent Expense balances to reflect what you really have at the end of the month. The adjusting entry TRANSFERS $1,000 from Prepaid Rent to Rent Expense.